July 8, 2016

Customer Loyalty

If you eat, sleep, and breathe growth, stop whatever you’re doing and pay attention. Why? Because investing in customer retention will get you unparalleled results. Don’t believe me? Here are three data points that will compel you to take immediate action: 1. Returning and repeat customers make up just 8 percent of visitors, but they deliver a whopping 40 percent of revenues according to an Adobe study of 33 billion visits to 180 ecommerce websites. In this context, a 1 percent increase in return shoppers would deliver a 10 percent increase in overall revenue. Now that’s ROI! 2. 71 percent of B2B customers feel disengaged with or indifferent toward B2B businesses and their offerings, according to Gallup’s findings in its 2016 Guide to Customer Centricity: Analytics and Advice for B2B Leaders. In other words, these customers—who make up nearly ¾ of your customer base—are ready and willing to walk away from your business any time. All it will take is a slightly better offer from one of your competitors. If that’s not a reason to take action, I don’t know what is. **3. The probability of selling to an existing customer is 60-70%, while the probability of selling to a new prospect is 5-20%****, **according to an Invesp infographic. The message is clear: If you want to boost your performance, spend more time on retaining valuable customers and less time looking for the next quick sell. By following the steps outlined in this post, you’ll be well on your way to maximizing customer retention.

Step #1: Find your most engaged (and disengaged) customers

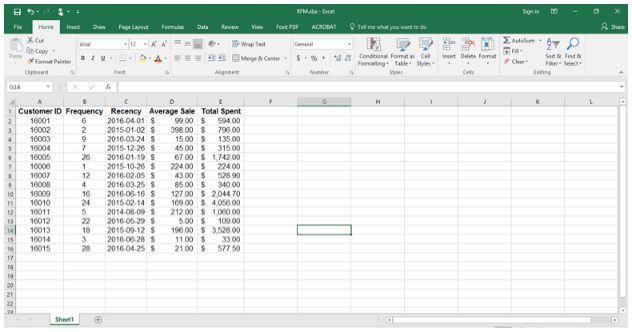

It’s time for a little predictive modeling with customer data. It sounds intimidating, but don’t worry—you don’t have to be a data scientist to uncover valuable insights. All you need to know is how recently each customer made a purchase, how often each customer makes purchases, and how much money each customer spends. These three data points enable you to produce an RFM (recency, frequency, and monetary) model. The premise behind the RFM model is simple: Customers who have made purchases recently, make purchases regularly, and spend a lot of money on your products and/or services are likely to respond favorably to future offers. At its core, RFM modeling is a segmentation tool. You can use RFM modelling to identify customers who are both engaged and disengaged.  Let’s get started. First, populate a table with the data mentioned above. It’s important to compile your data first, because you’ll need it when deciding how many categories to use for each RFM attribute. There’s no need to overcomplicate things—three to five categories will suffice. Using “recency” as an example, I’ve developed five categories:

Let’s get started. First, populate a table with the data mentioned above. It’s important to compile your data first, because you’ll need it when deciding how many categories to use for each RFM attribute. There’s no need to overcomplicate things—three to five categories will suffice. Using “recency” as an example, I’ve developed five categories:

- Customers who haven’t made a purchase in at least one year

- Customers who’ve made a purchase in the last year

- Customers who’ve made a purchase in the last six months

- Customers who’ve made a purchase in the last three months

- Customers who’ve made a purchase in the last month

Next, you’ll assign a score to each of these categories. I like to keep things simple. For example, if a customer has made a purchase within the last month, I’d give that customer a 5. But if a customer hasn’t made a purchase in at least one year, I’d give that customer a 1. Once you’ve performed these steps for each RFM category, every customer should have three individual scores and one total. Those customers with a high total score are your _most _engaged customers. Those customers with a low total score are your _least _engaged customers. Don’t stop there: You can gather powerful insights with further analysis. Take a closer look at your most disengaged customers. They usually fall into two or more categories. The first set of customers likely disappeared after purchasing a single product. But the second set spent a significant amount of money on your products and/or services in the past. These customers became disengaged only recently—within the last year or so. If you’re able to identify the second group in your data set, you have an opportunity.

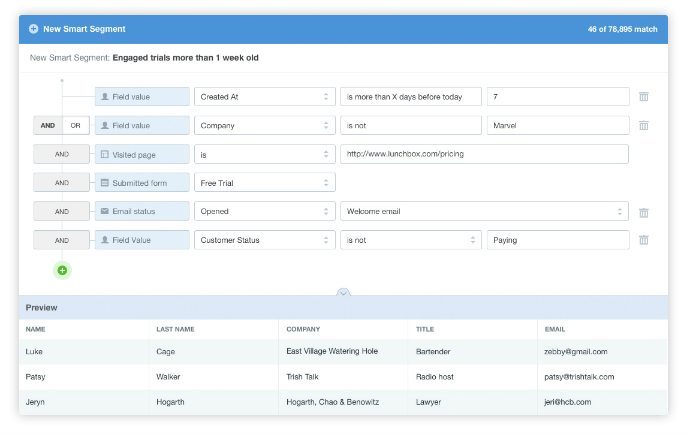

Step #2: Use marketing automation to offer compelling incentives to disengaged customers

Now that you’ve identified opportunities to reconnect with disengaged customers, let’s discuss one sure-fire way to win them back: marketing automation. Because marketing automation enables you to send offers triggered by an activity or event, you’ll never miss an opportunity again. Here’s how it works: Using Autopilot’s smart segments, you can define several audiences based on your RFM data. You can define each audience by recency (customers who haven’t made a purchase in over a year), by how much revenue they’ve contributed to your business in the past (revenues exceeding USD $2,500), by frequency (customers who made purchases at least once per month during the period in which they were active), or other relevant characteristics.  That’s why this tool is awesome: Because it enables you to create audiences based on a combination of fields. Which fields you choose is entirely up to you. Once that’s taken care of, you can design journeys triggered by audience membership. I like to think about journeys as roadmaps: guiding your customer from where they are now to where they need to go. The idea here is to offer disengaged customers purchase incentives (such as exclusive offers, coupons, discounts, and deals) that encourage them to resume the relationship. Remember: The premise behind RFM modeling is that customers who have made purchases recently, made purchases regularly, and spent a lot of money on your products and/or services are_ likely to respond favorably to future offers_. Be sure to tailor offers to each audience based on their customer lifetime value—the potential net value of doing business with them. There’s no reason to offer the same incentive to everyone. And don’t forget to experiment with split testing to determine what level of offer is appropriate for each segment.

That’s why this tool is awesome: Because it enables you to create audiences based on a combination of fields. Which fields you choose is entirely up to you. Once that’s taken care of, you can design journeys triggered by audience membership. I like to think about journeys as roadmaps: guiding your customer from where they are now to where they need to go. The idea here is to offer disengaged customers purchase incentives (such as exclusive offers, coupons, discounts, and deals) that encourage them to resume the relationship. Remember: The premise behind RFM modeling is that customers who have made purchases recently, made purchases regularly, and spent a lot of money on your products and/or services are_ likely to respond favorably to future offers_. Be sure to tailor offers to each audience based on their customer lifetime value—the potential net value of doing business with them. There’s no reason to offer the same incentive to everyone. And don’t forget to experiment with split testing to determine what level of offer is appropriate for each segment.

Step #3: Design a loyalty program that keeps valuable customers engaged

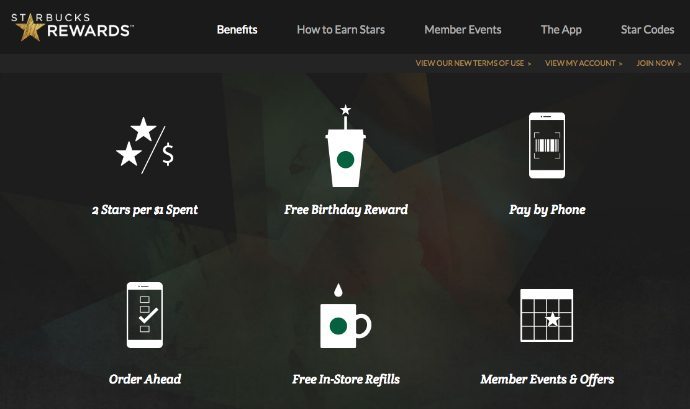

Reconnecting with disengaged customers should be a key element of your customer retention strategy. But you should also design loyalty programs that keep your most valued customers satisfied. Here’s why: Loyal customers are the most cost effective to serve. Why? Because they spend lots of money on your products or services, but need little investment to keep happy. Their commitment to your brand also makes them less sensitive to price changes, less likely to switch to a competitor, and more likely to engage in recommended behaviors. For example, they tend to forgive performance issues more readily than the average customer. They’re also the ones who exhibit a commitment to your brand—the ones who publicly promote your brand, products, or services. As the number of loyal customers increases, your business performance systematically improves. It goes without saying that there’s a strong relationship between loyalty and customer retention. So, how can you earn the loyalty of your best customers? By rewarding them!  Starbucks Rewards is a great example to learn from. The company showers rewards on people who join its loyalty program. Members receive benefits like paying with their phone, ordering ahead, and earning free drinks. Even if you don’t have the resources of Starbucks, there are still things you can do to keep people engaged. When customers promote your brand on their blog or on social media, send them a thank you message. For customers who do so continuously, send a free gift or give them a discount on a premium product or service. The idea here is to reward desirable behaviors. Experiment and figure out what rewards delight your audience. By designing a customer retention program using these three steps, you’ll increase customer engagement, multiply your customer retention rate, and maximize profits. What customer retention efforts have you ran at your company? How did they impact the bottom line? Let us know in the comments.

Starbucks Rewards is a great example to learn from. The company showers rewards on people who join its loyalty program. Members receive benefits like paying with their phone, ordering ahead, and earning free drinks. Even if you don’t have the resources of Starbucks, there are still things you can do to keep people engaged. When customers promote your brand on their blog or on social media, send them a thank you message. For customers who do so continuously, send a free gift or give them a discount on a premium product or service. The idea here is to reward desirable behaviors. Experiment and figure out what rewards delight your audience. By designing a customer retention program using these three steps, you’ll increase customer engagement, multiply your customer retention rate, and maximize profits. What customer retention efforts have you ran at your company? How did they impact the bottom line? Let us know in the comments.